Saving Bank Account

Features

- Can be opened by individuals and non-profit organizations

- Benefit of liquidity and interest to the a/c holder

- Collection of cheques in the account

- Interest payable on daily outstanding balance

- Minimum average balance in the form of MAB/QAB may be stipulated

- Standing Instructions (SI) may be issued

- ECS facility for utility bill/other periodical payments

- At par cheques (at all branches)

- Nomination facility

- Multiple access points-

- Branch (Home/non-Home) | ATM | BC | Net banking | Mobile banking | POS

Eligibility

- Individuals in single/joint names

- Associations, Clubs and other eligible non-profit institutions as per RBI guidelines

- Minors: Self operated (above 10 years of age)

- Minors: Guardian operated (below 18 years of age )

- Other permitted entities

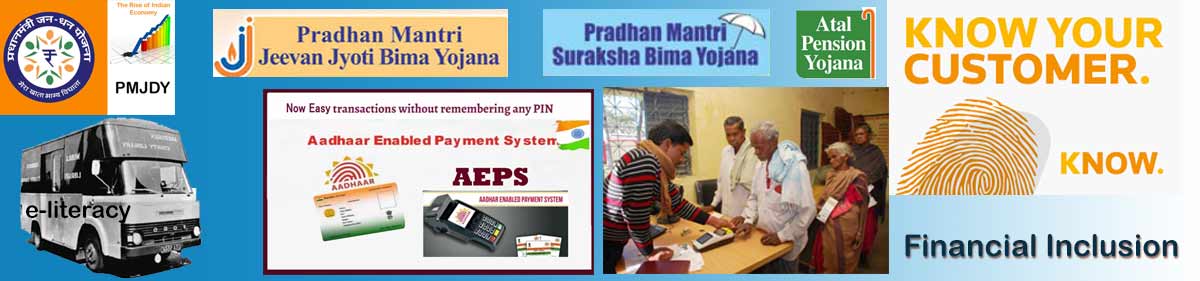

KYC Requirement

- KYC documents: ID & Address proofs

- Photographs

- Introduction by existing customers (not mandatory)

- PAN/ Declaration in Form 60/61

Rates & Others

- Click HERE for more details about Deposit interest rates& Service charges.

- For more quries please contact to your nearest branch.