Profile

Introduction:

Uttarakhand Gramin Bank, sponsored by the State Bank of India established under the RRBs Act 1976, came into existence on 1st Nov. 2012, after the amalgamation of the 2 RRBs viz. Uttaranchal Gramin Bank, Dehradun (Sponsored by SBI) & Nainital Almora Kshetriya Gramin Bank, Haldwani (Sponsored by Bank of Baroda) in Uttarakhand state.

| 1. Name of the Bank : | Uttarakhand Gramin Bank. |

| 2. Head Office : | 18, New Road Dehradun (Uttarakhand). |

|

3. Date of Establishment: |

01 Nov 2012 |

| 4. No. Of Regional Offices: | 4 (i) Dehradun (ii) Pauri Garhwal (iii) Pithoragarh (iv) Haldwani |

| 5. No. of Branches : | 286 |

| 6. Other offices : | Satellite Offices -11 : Extension Counters -2 |

| 7. Districts Allotted : | All 13 districts of Uttarakhand. |

Uttarakhand Gramin Bank is the Bank having second largest network of branches in Uttarakhand state after State Bank of India.

Other Particulars-

i) Branch Expansion

| Sr. No. | Category | Number of Branches |

|---|---|---|

| 1. | Urban | 14 |

| 2. | Semi Urban | 34 |

| 3. | Rural | 238 |

| Total | 286 |

| Sr. | Name of Districts | No. of branches |

|---|---|---|

| UNDER REGIONAL OFFICE-I, DEHRADUN | 86 | |

| 1 | DEHRADUN | 44 |

| 2 | TEHRI | 20 |

| 3 | UTTARKASHI | 07 |

| 4 | HARIDWAR | 15 |

| UNDER REGIONAL OFFICE-II, PAURI | 62 | |

| 5 | PAURI | 41 |

| 6 | CHAMOLI | 13 |

| 7 | RUDRAPRAYAG | 08 |

| UNDER REGIONAL OFFICE-III, PITHORAGARH | 38 | |

| 8 | PITHORAGARH | 30 |

| 9 | CHAMPAWAT | 08 |

|

UNDER REGIONAL OFFICE-IV,HALDWANI |

100 | |

| 10 | ALMORA | 30 |

| 11 | BAGESHWAR | 13 |

| 12 | NAINITAL | 37 |

| 13 | UDHAM SINGH NAGAR | 20 |

(ii) STAFF:

A. Officers on Deputation from Sponsor Bank:

| i) Chairman | |

| ii) General Manager : | 3 |

| iii) Other Officers : | |

| a)SMGS-V : | 1 |

| b)SMGS-IV : | 1 |

| Total : | 6 |

B. UGB Staff

| S.No. | Category | Total No. |

|---|---|---|

| 1. | Supervising - Total | |

| a) Officer Scale-IV | 09 | |

| b) Officer Scale-III | 78 | |

| c) Officer Scale-II | 192 | |

| d) Officer Scale-I | 285 | |

| 2. | Office Assistants | 366 |

| 3. | Subordinate | 47 |

| Total | 977 | |

C. Officers on deputation from other Banks:

Under Inter Bank Deployment of RRB Officers: NIL

D. Officers deputed to other RRBs:

NIL

[iii] Business performance

(Rs. in lacs)

| Item | Actual March '15 |

Actual March' 16 |

Actual March '17 |

|

|---|---|---|---|---|

| a) Deposits | 314262.20 | 335005.12 | 413025.38 | |

| b) Advances | 175327.28 | 194559.22 | 198155.06 | |

| i) Priority Sector | 135272.75 | 146003.42 | 142712.48 | |

| ii) %age of Priority Sector to Total | 77.15 % | 75.04 % | 72.02 % | |

| c) CD Ratio (%) | 55.79 % | 58.08 % | 47.98 % | |

| d) Profit i) Before Tax | 690.46 | 148.08 | 462.44 | |

| ii) After Tax | 265.24 | 128.69 | 384.37 | |

| e) Total Business | 489589.5 | 489598.18 |

|

|

| f) Busi. Per Branch | 1711.85 | 1711.88 | 2136.99 | |

| g) NPAs i) Absolute | 11569.28 | 19757.21 | 19553.76 | |

| ii) NPAs (%) | 6.60 % | 10.15 % | 9.87 % | |

| h) KCCs issued (During the period) | 6238 | 5517 | 2589 | |

| i) SHGs Formed (During the period) | 1575 | 2281 | 2062 | |

| j) SHGs Linked (During the period) | 800 | 1064 | 341 | |

| l) CBS Branches | 286 | 286 | 286 |

(iv) ANNUAL CREDIT PLAN ACHIEVEMENT:

(Rs. in lacs)

| Target 2016-17 | Achievement 2016-17 | |

|---|---|---|

| Amount | Amount | % |

| 121737.00 | 67688.95 | 56.00 % |

(v) INVESTMENTS

(Rs. in lacs)

| Sr.No. | Particulars | Amount As on 31.03.17 |

|---|---|---|

| 1. | SLR- Govt. Securities | 161380.63 |

| 2. i) | Non SLR - | |

| i) | Mutual funds | 1580.31 |

| ii) | Debentures & Bonds | 4307.20 |

| iii) | Other Securities | 2676.46 |

| iv) | FDs with SCBs- Total | 69428.43 |

| Total -NON SLR | 77952.4 | |

| Total Investments | 239333.03 |

(vi) GOVT. INITIATIVE ON AGRICULTURE

i) Financing of Agriculture

(Rs. in lacs)

| Particulars | 2016-17 |

|---|---|

| 1. Agriculture Disb. | 23888.90 |

| 2. Agriculture Outstanding | 42951.70 |

| 3. % of Agri. to Total | 21.67 % |

ii) NEW FARMERS ACCOUNTS OPENED

(Rs. in lacs)

| Position as on March 17 | New farmers financed 2016- 2017 | |

|---|---|---|

| 10491 |

(vii) Inspection Rating of Branches:

| 31.03.17 | |||

|---|---|---|---|

| 1. Excellent/ A+ | 104 | ||

| 2. Good /B | 157 | ||

| 3. Satisfactory/ C | 25 | ||

| 4. UnSatisfactory | - | ||

| 5.New branches not audited | 26 | ||

| Total (Branches) | 286 |

(viii). C.D. Ratio ASCB (All Sch. Comm. Banks) vis a vis Uttarakhand Gramin Bank:(31.03.2017)

| Sr.No. | District | CD Ratio of ASCB |

CD Ratio of UGB |

|---|---|---|---|

| 1. | Uttarkashi | 47 % | 107.24 % |

| 2. | Dehradun | 42 % | 51.23 % |

| 3. | Haridwar | 65 % | 98.87 % |

| 4. | Tehri | 46 % | 47.69 % |

| 5. | Pauri | 24 % | 35.44 % |

| 6. | Chamoli | 29 % | 42.16 % |

| 7. | Rudra Prayag | 26 % | 49.23 % |

| 8. | Pithoragarh | 37 % | 45.76 % |

| 9. | Champawat | 31 % | 35.47 % |

| 10. | Almora | 20 % | 23.31 % |

| 11. | Bageshwar | 23 % | 33.73 % |

| 12. | Nainital | 45 % | 51.28 % |

| 13. | Udham Singh Nagar | 122 % | 120.59 % |

HIGHLIGHTS OF PERFORMANCE DURING 01.04.2016 TO 31.03.2017:

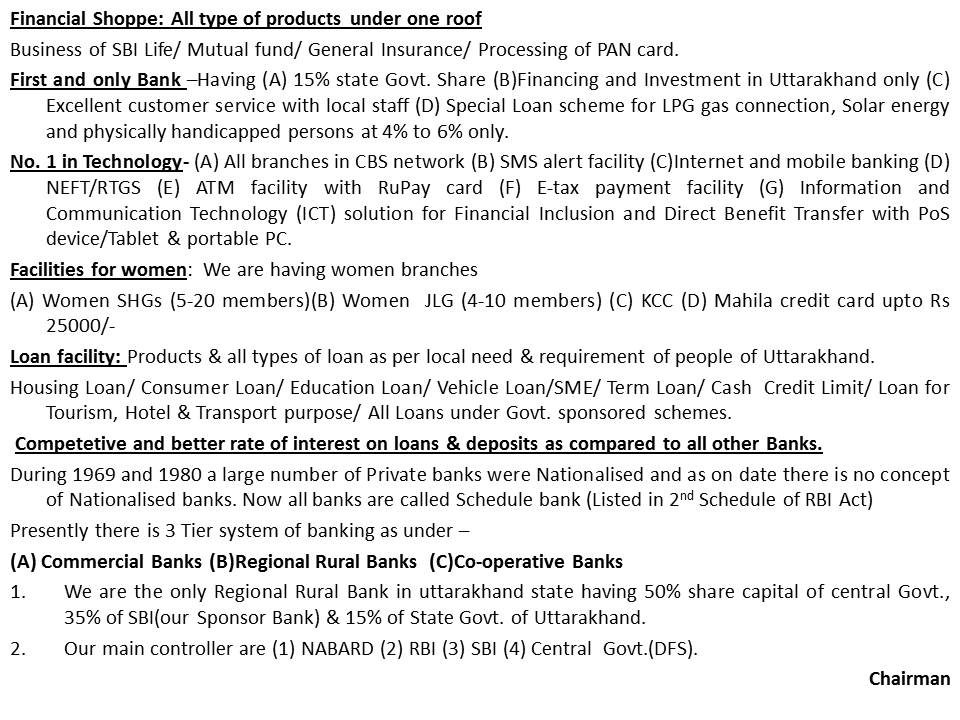

- 100% branches are in Core Banking Solution (CBS).

- Advance Technology with ATM, NEFT, SMS Alert, Internet Banking etc.

- Tie-up arrangement with SBI Life Insurance Co. Ltd. 7 MDRT in a year.

- Tie-up arrangement with National Insurance Company Ltd.

- Tie-up arrangement with SBI Mutual Fund for marketing of Mutual Funds.

- Tie-up arrangement with M/s Force Motors for financing of vehicles.

- Tie-up arrangement with M/s International Tractors for financing of Tractors.

- Tie-up arrangement with M/s Honda Motors for financing of two wheelers.

- Recruitment of 131 Office Assistants and 39 Officers.

- NRE/NRO Accounts & Western Union Money Transfer facility launched.

- PAN Card issuance facility available.

- regular publication of in-house magazine "Gangotri".